-

8 January 2020

Forum

Notifications

Clear all

Topic starter

January 8, 2020 11:50 am

Bosses are wary of the return of the corporate raider

Image copyrightGETTY IMAGES

Image copyrightGETTY IMAGESWhen Chefs' Warehouse flew Christina Carroll from California to her first board meeting they put her up in a haunted hotel.

It was not clear which was the bogeyman, the hotel or Ms Carroll, for she was not a normal board member but had been hired by an activist investor, Legion Partners, to turn the firm around.

Unlike a typical shareholder, an activist buys enough stock to corner the vote on important company decisions - like appointing board members or firing chief execs.

Legion Partners bought 5.9% of shares, garnered the support of fellow shareholders and demanded a seat in the boardroom. Legion's method is to buy a struggling company's shares at a low price, turn the firm around and sell at a profit once the business and its share price have improved.

Image copyrightCHEFS WAREHOUSE

Image copyrightCHEFS WAREHOUSELegion Partners' only demand was for Chefs' Warehouse to appoint Ms Carroll to join its board. Ms Carroll is a specialist in understanding the value of things a company has on its balance sheet. She had worked previously with Houlihan Lokey, an investment bank and Ernst & Young, a consultancy firm.

Chefs' Warehouse was lucky. Legion Partners is the new, gentler version of what used to be called a corporate raider.

A few high-profile raiders became famous in the 1980s for buying companies and dismembering them, making big profits for themselves but often leaving thousands of workers unemployed.

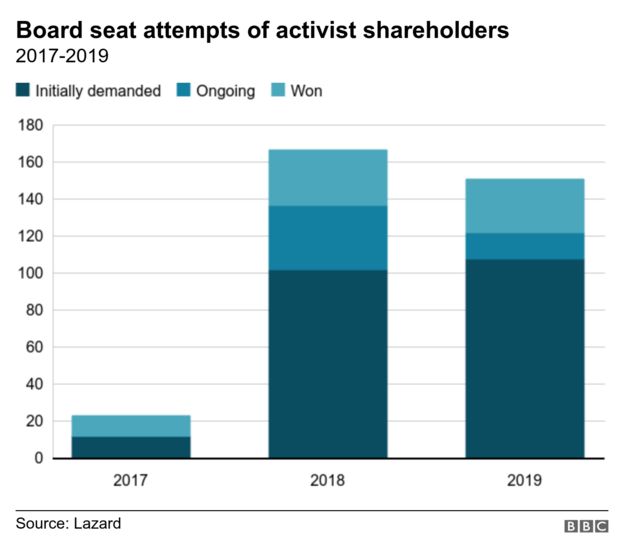

And in the past two years, the number of investors using similar tactics to buy their way into underperforming companies has boomed, according to the investment bank Lazard. 2019 saw a record-breaking total of $11bn worth of shares bought and 71 separate campaigns launched, the research found.

Image copyrightLAZARD

Image copyrightLAZARDSo are today's so-called activists a new wave of raiders under a different flag?

"Some of us deserved that title and some of us didn't," says Paul Bilzerian, one of the last of these raiders left alive.

Mr Bilzerian describes American corporate management in the 1980s as "uniformly horrible". Companies had no regard for their shareholders, he says: "People like Carl Icahn, T Boone Pickens and I - we changed the game."

They would go through a company's financial accounts and find the loss-making parts. Then they would buy up shares, take over the firm and carve those pieces out. Sometimes the process was brutal.

In 1985, Mr Icahn took over TWA, the now defunct American airline. He loaded it with debt, sold its most valuable flight routes and ground the airline into bankruptcy.

But the fear of raiders had its merits, says Mr Bilzerian. Executive and boardroom behaviour cleaned up - or else. "They knew guys like me would buy the company and throw them out."

Mr Bilzerian acquired Singer, the American sewing machine company, which had diversified into weapons manufacturing during and after World War Two. He aimed to turn it around, but the backlash against corporate raiders had already begun.

Image copyrightGETTY IMAGES

Image copyrightGETTY IMAGESThe US regulator the Securities and Exchange Commission charged him with failing to file financial documents and he was forced to resign. Singer was carved up after he left and today has returned to sewing.

Today's descendants of these raiders work on a spectrum. Cheap and easy access to detailed financial information has meant an explosion of shareholder activism.

"Shareholders are no longer willing to buy a ticket and go along for the ride. They are increasingly vocal, engaged and willing to support an activist's thesis,'' says Rich Thomas, head of Lazard's shareholder advisory practice in Europe.

Activism may have become entrenched in many company annual general meetings and it is changing the economy, but the subject remains contentious.

'Economic detriment'

"The problem is that most activism is not cordial, nor is it focused on long term strategy," says Martin Lipton, a founding partner of Wachtell, Lipton Rosen and Katz who has been defending companies against activist approaches since the 1970s.

Topic starter

January 12, 2020 1:35 pm

The investor buys a lot of the corporation shares and the business assets are not good. The activist now has most of the voting rights. This will cause changes in the management and the leaders of the company. Some would call it an illegal venture