Small Business Administration References

Created in 1953, the U.S. Small Business Administration (SBA) continues to help small business owners and entrepreneurs pursue the American dream. The SBA is the only cabinet-level federal agency fully dedicated to small business and provides counseling, capital, and contracting expertise as the nation’s only go-to resource and voice for small businesses.

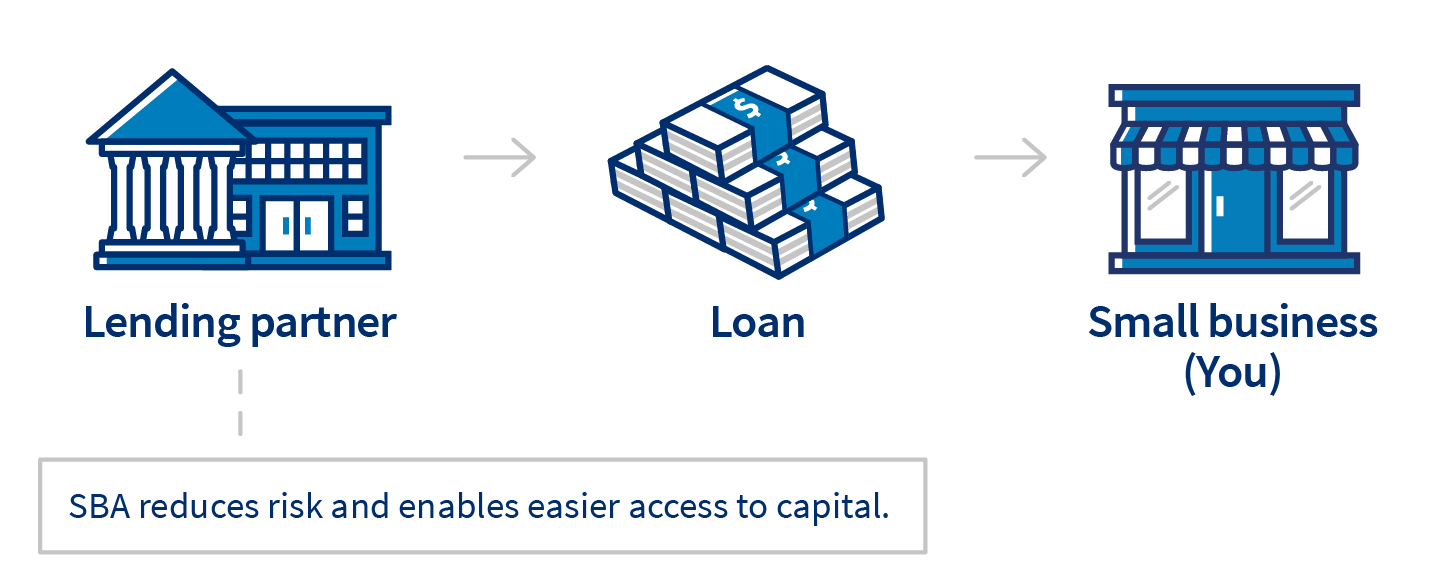

The SBA helps small businesses get loans

The SBA works with lenders to provide loans to small businesses. The agency doesn’t lend money directly to small business owners. Instead, it sets guidelines for loans made by its partnering lenders, community development organizations, and micro-lending institutions. The SBA reduces risk for lenders and makes it easier for them to access capital. That makes it easier for small businesses to get loans.

SBA Coronavirus News & Resources

Joint Statement by Secretary Steven T. Mnuchin and Administrator Jovita Carranza on the Review Procedure for Paycheck Protection Program Loans

U.S. Treasury Secretary Steven T. Mnuchin and U.S. Small Business Administrator Jovita Carranza issued the following statement on the Paycheck Protection Program (PPP):

“The Paycheck Protection Program is providing critical support to millions of small businesses and tens of millions of hardworking Americans. We have noted the large number of companies that have appropriately reevaluated their need for PPP loans and promptly repaid loan funds in response to SBA guidance reminding all borrowers of an important certification required to obtain a PPP loan. To further ensure PPP loans are limited to eligible borrowers, the SBA has decided, in consultation with the Department of the Treasury, that it will review all loans in excess of $2 million, in addition to other loans as appropriate, following the lender’s submission of the borrower’s loan forgiveness application. Regulatory guidance implementing this procedure will be forthcoming.

We remain fully committed to ensuring that America’s workers and small businesses get the resources they need to get through this challenging time.”

The SBA is hiring temporary employees to assist with disaster relief efforts during these unprecedented times. The positions include:

- Call Center Customer Service Representative

- Document Preparation/Legal Review/Loan Closings

- Loan Processing/Credit Analysis/Mortgage Underwriting

- Program Support

Beware of Scams and Fraud SchemesThe Office of Inspector General recognizes that we are facing unprecedented times and is alerting the public about potential fraud schemes related to economic stimulus programs offered by the U.S. Small Business Administration in response to the Novel Coronavirus Pandemic (COVID-19). The Coronavirus Aid, Relief, and Economic Security (CARES) Act, the largest financial assistance bill to date, includes provisions to help small businesses. Fraudsters have already begun targeting small business owners during these economically difficult times. Be on the lookout for grant fraud, loan fraud, and phishing.

Employee Retention Credit – CARES Act (FAQs)The IRS has posted updated Frequently Asked Questions (FAQs) to IRS.gov providing answers regarding the Employee Retention Credit under the CARES Act. The Employee Retention Credit under the CARES Act encourages businesses to keep employees on their payroll. The refundable tax credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19.

Federal Coronavirus ResourcesState, local, and federal agencies are working together to maintain the safety, security, and health of the American people. Check out coronavirus.gov for updates from the White House’s Coronavirus (COVID-19) Task Force. Go to cdc.gov for detailed information about COVID-19 from the Centers for Disease Control and Prevention.

Virtual Mentoring and Training Offices around the country may be closed to the Coronavirus pandemic, but SCORE, Small Business Development Centers, Women’s Business Centers, and Veterans Business Outreach Centers and other resource partners are providing free business mentoring and training by phone, email, and video.

SBA District and Regional Office Webinars on Disaster Assistance SBA district and regional offices are offering webinars about Economic Injury Disaster Loans.These webinars explain SBA’s Economic Injury Disaster Loan program and how you can apply for disaster assistance.

Sign up for SBA newsletters using your zip code to get updates